Structural renovations usually come with a hefty price tag, and the majority of homeowners with a mortgage do not have an abundance of funds lying around to pay for their home improvements. If you are in this position, there is an option available to you – refinancing. You can use this checklist to help you get started.

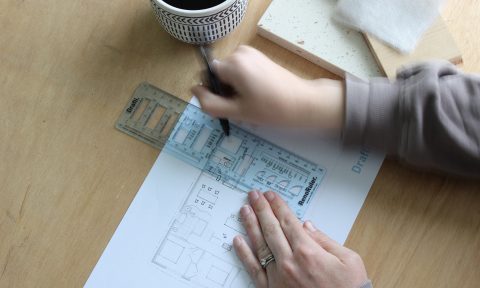

How much will the renovations cost?

Once you have decided that you want to make improvements to your home you should consider your options and acquire a few different quotes from licenced tradesmen. When you have an idea of the estimated cost of the renovations, you can sit down and realistically work out whether you can afford the project.

Task: Get at least three quotes from trusted, licensed tradesmen.

Can you afford the project?

Renovating your home requires complete commitment personally and financially to ensure that the improvements are as effective as possible, adding the maximum value they can to your home. It is important that you carefully consider your decision to take on a home improvement project including consideration of your financial circumstances, any foreseeable changes to income, and your ability to service higher loan repayments should your project increase your loan amount.

Task: Check if you have financial capacity to take on the project.

What is the value of your home?

To refinance, you need to get your home valued. To get approval it may be recommended that you get the value of the renovations included in the value of the home, as this could improve your borrowing capacity. To do this you will need to provide the building contracts and quotes of the proposed renovations.

Task: Get a formal valuation done on your home or ask your mortgage broker for a valuation.

Are interest rates low?

Regardless of whether you need the money to renovate or not, looking at your refinancing options every year or so is important as interest rates can decrease, offering you better conditions and monthly repayments on your mortgage. It also allows you to take out cash from your home to pay to use for large purchases (e.g. renovations).

Task: Check your current interest rate and compare with current market conditions, your mortgage broker will be able to help you with this.

Are you ready to take the next step?

Once you have considered everything and have decided that you would like to try to refinance your loan to access a lower rate, additional loan features, or funds for home improvements, you will need to contact your mortgage broker to determine whether you meet the criteria and to start the formal application process. Generally speaking, you will require the following:

- Existing home loan details and 3 months of mortgage statements;

- Income details – two consecutive pay slips and group certificates; and

- If self-employed, two years of personal and business tax returns and financials.

Task: Contact your bank or mortgage broker to ensure you meet loan application criteria and to discuss your borrowing capacity.

–James Pibworth is managing director of Iconic Home Loans. The information provided here is general advice only, and your personal and financial circumstances have not been taken in to consideration during the preparation of this information. It is recommended that you seek independent financial advice before making any decisions involving your personal finances.Finance/refinance availability is subject to applicant meeting criteria, and all approvals are at the discretion of the lender.