Renovating a house – for lifestyle or profit – is a big financial commitment. And for most of us, that means borrowing the money to do the work. There are lots of different ways to finance a renovation but the key to optimising your success is to find the one that best suits your situation.

This is the third in a series (read the first and second article) outlining the different ways a renovation can be funded and how you can navigate the huge range of products to find out which is the best option for you. Renovating can be a stressful undertaking, so knowing you have made the right decision about funding your project from the beginning is a great way to start!

Construction loans

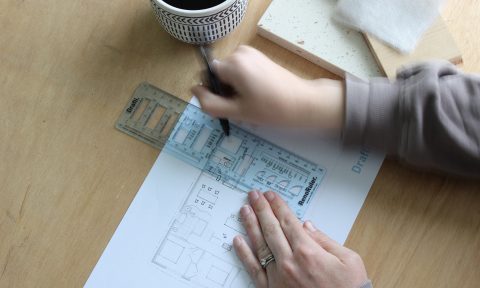

Has the time come for your game-changing reno? A second storey or a total revamp that takes your home to the next level? If so, financing your project with a construction loan is often one of the cheapest and best ways to fund it.

Construction loans are great for major renovation projects; for example, a renovation that needs council approval or when building costs are going to exceed $100,000 and you don’t have enough equity sitting in your home to draw from.

There are many reasons people find themselves needing a construction loan and it’s always an exciting stage to be at, because it means change is in the air – there’s a baby due, so a family needs a bigger house; or someone has decided to open a home office and needs to build one; or a couple has decided to bite the bullet and finally make their dream home a reality.

This type of financing works by basing the loan amount on the estimated value of your home after the renovation is complete; and rather than your lender giving you access to the money up front, instalments are paid directly to the builder as the project progresses. You will generally be able to borrow up to 90% of the completed value of your home.

When you apply for a construction loan, lenders need to see your council-approved plans and your contract with a licensed building contractor. At this stage, the lender will often send a valuer to your home to ensure your project will meet the loan criteria.

Lucy and Ross came to see me when they needed to borrow $300,000 for a major renovation on their home in Newcastle. The plan was to gut the existing two-bathroom, three-bedroom house, build on two more bedrooms, a bathroom and a large family living space and deck out the back.

They originally bought the home six years ago and already had a $400,000 mortgage. Before the work, their home was worth $600,000, so borrowing the $300,000 up front wasn’t an option because the total loan of $700,000 would have exceeded the home’s pre-reno value. So I suggested they take out a construction loan so they could borrow all the money they needed to complete their renovation.

The first step was to estimate the completion value of the home. Not only was this a vital step in the construction loan process, it was also important to ensure Lucy and Ross would not be over-capitalising on their home when they did the work. (We will talk about over-capitalising in the coming weeks).

It was estimated their home would be worth $900,000 once the work was done – meaning they would owe $700,000 on a $900,000 home, which was well within 90%.

It was all smooth sailing for Lucy and Ross, which meant at the end of the process their renovation was finished exactly the way they wanted it done; and they were able to settle happily into their dream home for the foreseeable future, knowing that their repayments were affordable and the value of their house had increased and would more than likely, continue to do so.

— Paul is the Director of CVG Finance, a leading brokerage offering financial services across all areas.