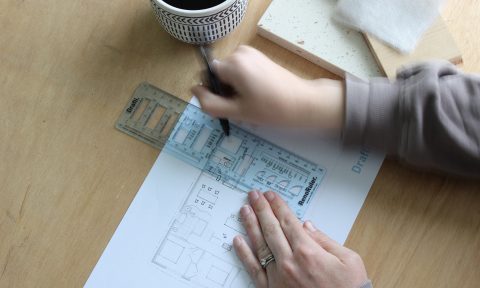

As renovation reality shows like The Block boom in popularity, more homeowners are willing to get their hands dirty and tackle home revamps. Whether it’s to boost the property’s selling value or to create a space that’s more practical and appealing, smart home renovation investments are becoming more popular than ever. But financing the dream can be challenging for many of us!

If you have decided to take the leap and transform your tired looking home, putting a realistic budget in place for the project is vital. You may need to borrow more money, refinance your existing loan or utilise other financing options; regardless it’s paramount to find a way to stay within your budget. Here are some tips to keep your wallet – and your home – happy.

Top Financial Advice for Home Renovators

1. Know why you are renovating

It’s important from the beginning of a renovation project to know why you’re doing it – whether it’s renovating to make living in your home more comfortable for yourself or renovating to sell and hopefully making money out of it. Whatever the reason, it’s important to plan and do your research otherwise you could end up worse off.

2. Focus on the essentials: kerb appeal and cosmetic renovation

One of the biggest money pitfalls of renovations is focusing on the wrong things. Sure, you might want the extravagant lounge area with all the trimmings but it’s best to focus on the essentials first – especially if you’re renovating to increase return on investment. Kerb appeal is one of the first big ticket items to focus on – first impressions do count. You don’t need to fork out a lot of money to create that ‘wow’ factor. A fresh coat of paint, basic landscaping tricks and bright bold numbering on your mailbox can have a huge impact.

Unless you need too (or have budgeted for it) hone in on cosmetic changes over structural. The kitchen and bathroom are where buyers want to see modern appeal, ample storage areas and improved lighting and ventilation. Cosmetic renovations are great for concentrating on the fundamentals to avoid overcapitalising or giving the home that ‘half-baked cake effect’.

3. Don’t blow the budget

It’s easy to blow the budget when it comes to home renovations. If you’re looking at doing a cosmetic renovation, stick to the 10% rule to keep renovation costs to a minimum. Use 10% of the property value to do the cosmetic renovation (what your home is valued at now, not what you bought it for). For example: if your home’s current value is $400,000, allow $40,000 to complete the renovations. This will help to ensure you don’t blow the budget, cover the whole house for a cosmetic renovation and give you a decent return on investment explains Cherie Barber who runs Renovating for Profit.

A big key to sticking within your budget is to set realistic expectations. Don’t plan for an excessively high budget if you have no means of meeting it. Plan the budget up front and don’t forget to build in a contingency plan for unexpected costs, which will almost always occur, during the renovations.

4. Utilise bank redraw

If available with your bank, redrawing from your home loan can be a smart financial move to assist with renovations. Not all financial loans have a redraw option so you’ll need to check with your mortgage broker to determine whether you can apply. Redraw amounts will also vary between banks and loans.

In terms of your home loan’s interest, redrawing is one of the least expensive forms if cash isn’t an option. Essentially it’s like using your own savings from additional loan payments that have accumulated over time. The downfall though is it only works if you’ve been making advance payments on your loan. And you’ll want to ask about redraw fees too, as some banks will charge for this option.

5. Don’t overlook the more inexpensive remodel jobs

Some of the best financial advice for home renovation lies with what jobs you target. As mentioned above, the big essentials are kerb appeal and a full cosmetic renovation, but that’s not to say you shouldn’t underestimate the importance of inexpensive remodelling jobs. Things like a fresh coat of paint can offer the best return of investment of many home improvement options, or consider replacing the front door and updating fixtures for other easy ideas.

Adding or rejuvenating landscaping out the front and back will go a long way too and doesn’t need to cost you an arm and a leg. Removing carpet and installing cost-effective hardwood floors can give you a return of investment from 50%-75% too.

6. Financing the Facelift

Besides utilising a redraw on your loan, there are a number of options to take advantage of for financing the facelift. From home equity loans, construction loans which allow you to borrow against the value of your property and offset accounts, there’s something to suit most situations. A line of credit may be an option as well – it provides you with the option to draw additional funds from the home loan with a set limit and helps to avoid transaction fees with reduced interest.

Regardless of what financing option you choose, it’s paramount to think long term. Use your own personal experiences and those of other homeowners you know who have renovated in the past for ideas and speak to a mortgage broker to determine which suits your needs best. With the right financial help and tackling the best renovation jobs for the ultimate return on your investment, it won’t take long before your property is finished and looking great – all without breaking the bank!

By Kate Beaumont, Mortgage Finance Broker at Blueprint Wealth

Kate Beaumont is an authorised representative and credit representative of AMP Financial Planning.

Blueprint Planning Pty Ltd (ABN 78 097 264 554), trading as Blueprint Wealth, is an authorised representative and credit representative of AMP Financial Planning, Australian Financial Services Licensee and Australian Credit Licensee.

This article contains information that is general in nature. It does not take into account the objectives, financial situation or needs of any particular person. You need to consider you financial situation and needs before making any decisions based on this information.